Project Definition

Oracle, Orange and Mobile UX London have held a 2 days Hackathon at Oracle London office. The focus of this event was to showcase Rich Communication Services and how we can give people a better understanding of what’s in store for the future.

Introduction

At the end of this event, my team of five created a chatbot prototype that helps people to control their financial situations, have savings, helps payments.

Our prototype based on the functionalities of Rich Communication Services (RCS), Chatbots and Open Banking. Rich Communication Services (RCS) is a communication protocol between mobile-telephone carriers and between phone and carrier, aiming at replacing SMS messages with a text-message system that is richer, provides phonebook polling (for service discovery), and transmit in-call multimedia.

Messaging is also a great way for companies to connect with clients who are engaged with their apps. It provides an opportunity to start an instant conversion like making offers, promotions, sharing the shipping status of an order, the upcoming payment of a bill.

Marketers also have a chance to enrich their campaigns by using mobile app open that uses Rich Push message when a user opens the notification. Push notifications with a Rich Push message are useful.

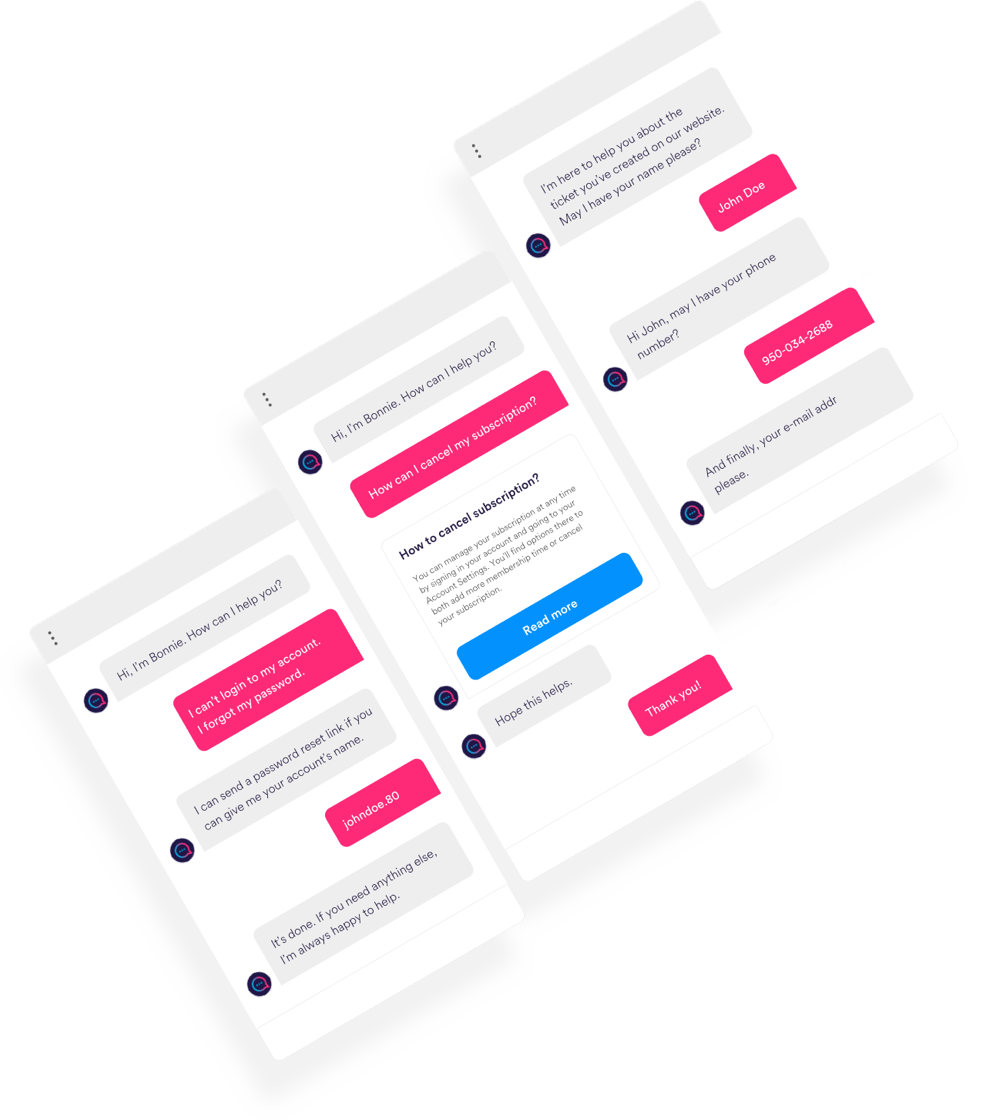

Chatbots – also known as “conversational agents” – are software applications that mimic written speeches for the purposes of simulating a conversation or interaction with customers. Chatbots are used most commonly in customer services.

Conversational agents are becoming much more common partly due to the fact that creating chatbots are becoming easy. Today, you can make your own chatbot based on Facebook Messenger.

Here some chat bot tools you can find in the market:

- Live Person – https://www.liveperson.com

- Live Chat – https://www.livechatinc.com

- Amazon Lex – https://aws.amazon.com/lex

- ChattyPeople- https://www.chattypeople.com

- MEOKAY – http://meokay.com

- Botsify – https://botsify.com

- Chatfuel – https://chatfuel.com

- Facebook Messenger Platform – https://developers.facebook.com

- Telegram Bots – https://core.telegram.org/bots

- BotKit – https://botkit.ai

- FlowXO – https://flowxo.com

- ManyChat – https://manychat.com

- Botsociety – https://botsociety.io

- Motion.ai – https://www.motion.ai

- Morph.ai – https://morph.ai

From our experiences and research finding in the financial sector. There are some pain points that financial companies and their customers suffer from. Customers suffer from paying banking fees. Entering into the collections process is an unwanted situation for both parties. The lack of direct and instant communication between customers and lending companies for preventing the miss repayments is another problem in the financial sector. Also creating a service for helping people who are in financial difficulty.

Lending companies like banks have to collect their unpaid debts from clients. These unpaid debts can be loans, credit cards, unpaid bills, missed mortgage payments. If the customer missed one or two payments, they will enter collections. This is a costly process for a bank by means of effort and time to recover these payments. Also for the customer side, it isn’t good for the customer by means of credit score or having additional costs to them.

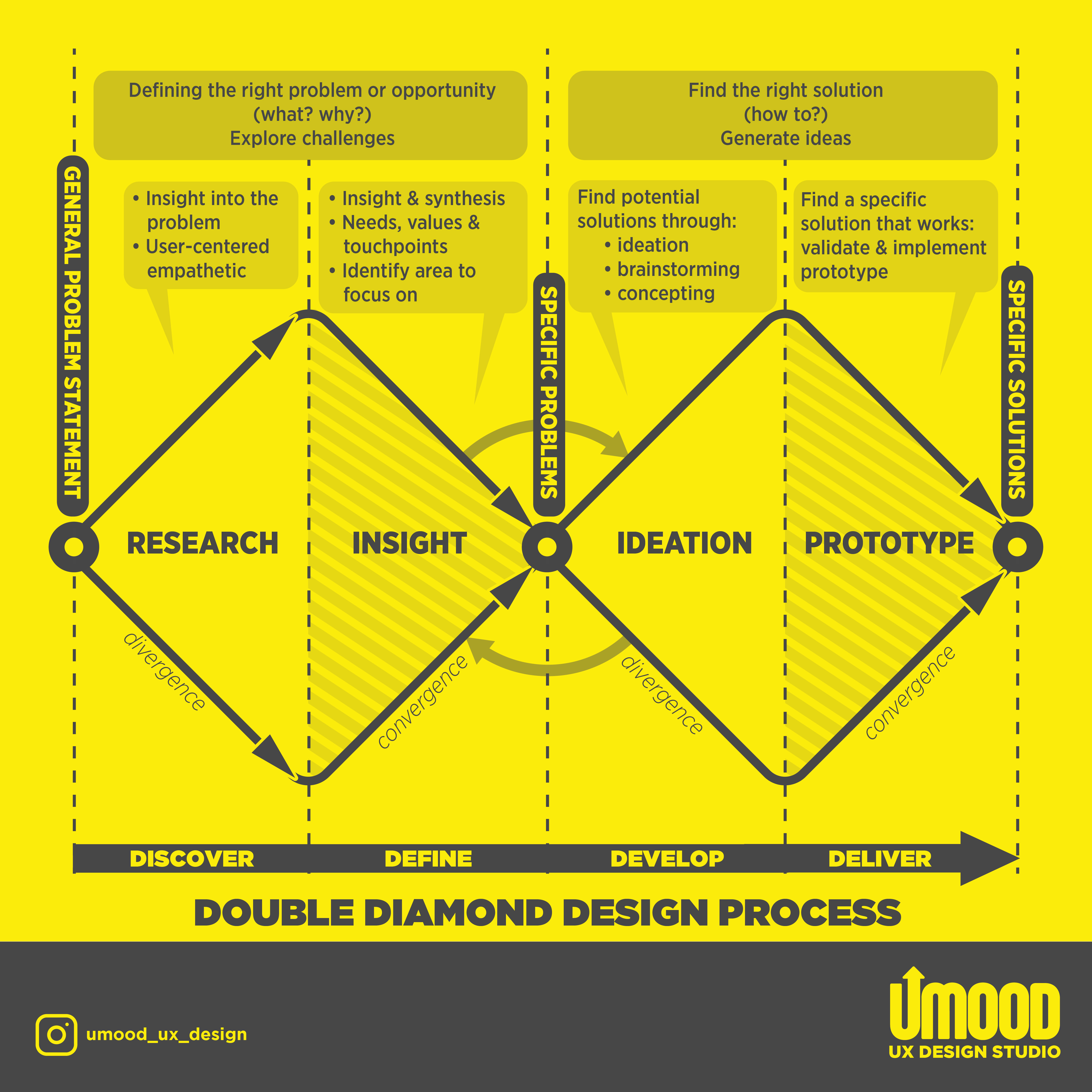

Design Process

There are different approaches and ways for following a creative process. We would like to follow a well-known model defined by the Design Council called Double Diamond. This model includes a discovery phase that gives us a chance to create an insight into the problem, a definition phase that will be a foundation for the further creative process. The third phase is the development phase for creating a prototype. The last phase is the delivery stage for the final version of our product.

We focused on the current collections processes, personas, possible solutions, user scripts and the prototype. We didn’t follow the exact user centre design given time and resources.

We started our research by understanding the collections process that banks and collections agencies follow today. This prepared us to understand the challenges lenders face when lending money or being owed money.

Collections process can be defined as the following:

- Customer misses a payment

- Lender sends warning letters

- The customer is charged a fee

- Lender continues to try to contact the customer with letters and calls.

The aim of this is to:

- Understand why customers missed their payments

- Try to collect outstanding payments

- Understand if this a short-term issue or something more serious

- Avoid having to write off outstanding balances for individuals who have no intention of paying back

Personas

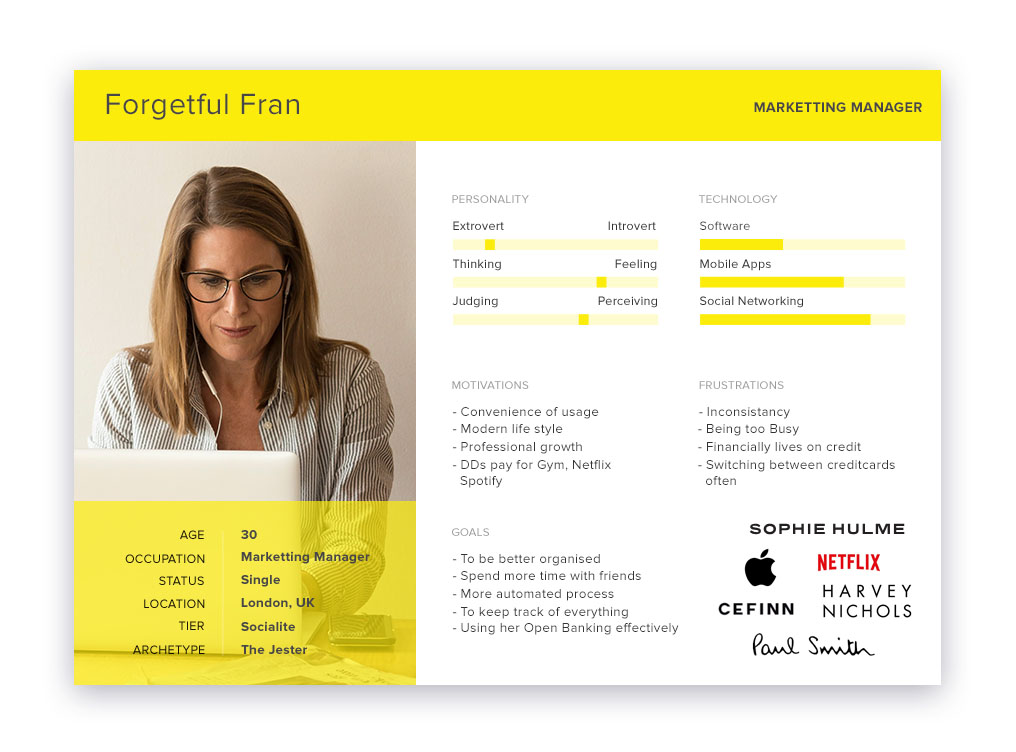

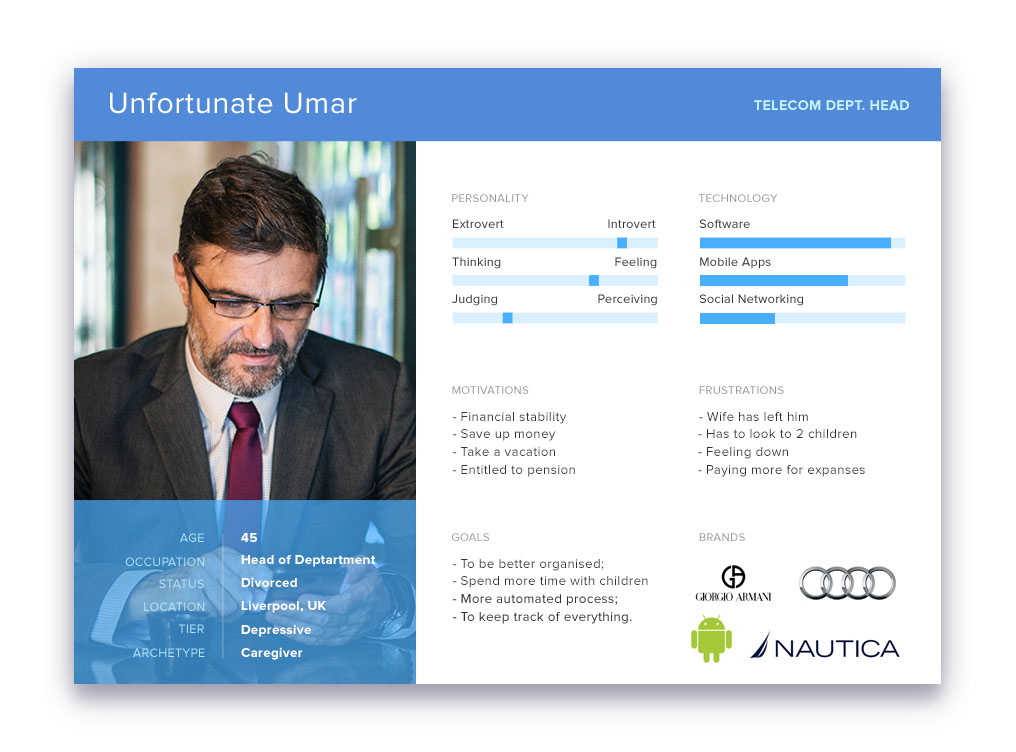

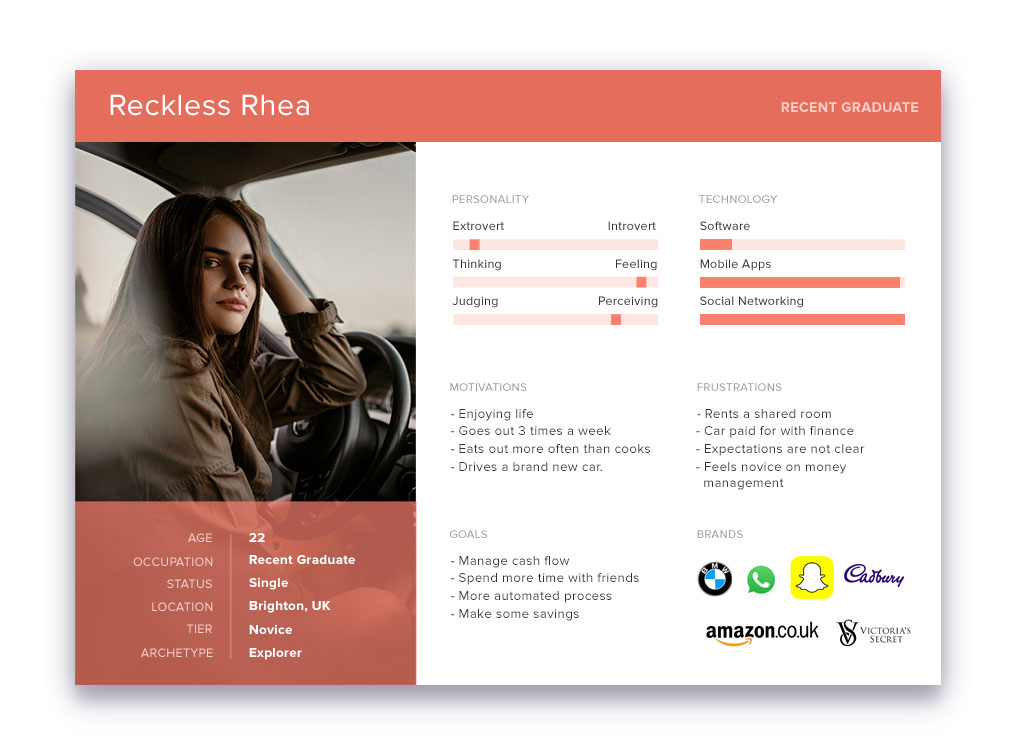

To better understand who we would be trying to solve for, we created 3 personas which fall into the category of people who fall into collections this was based on research and previous knowledge on the subject:

Ideation

Once we had established the personas, we moved onto brainstorming different solutions which could solve these problems while using a chatbot.

Once we had an idea of the different solutions, we started to map out the user journey and user scripts for our chatbot prototype.ablished the personas, we moved onto brainstorming different solutions which could solve these problems while using a chatbot.

Our Solution

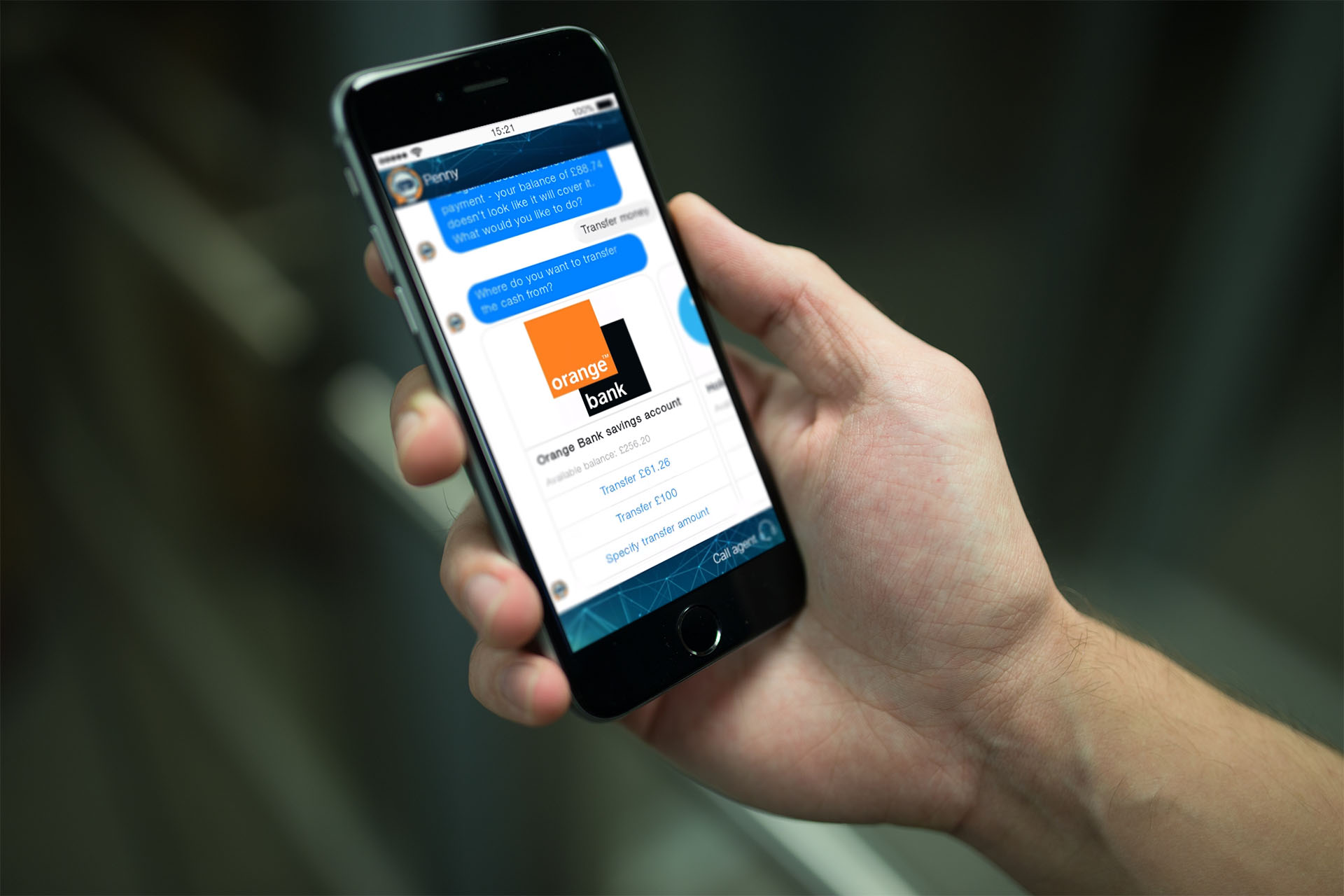

Introducing Penny the Financial Assistant

How will it work?

- Uses Open Banking

- Continually assesses user’s income and expenditure

- Warns the user if their balances won’t cover upcoming outgoing payments

- Offers quick solutions to avoid fees e.g. transfer money from other account or pay now with a bank card

- Provides options to make arrangements if a customer is having financial difficulties such as change direct debit dates, take repayment holidays or interest freezing; if Penny deems necessary

- Assesses financial problems, change of circumstances or any other issues, which will trigger Penny to provide support e.g. point user towards free organisations that can provide advice such as citizens advice bureau

Personality

When building a chatbot, creating the chatbot’s personality or persona is very important – this directs the type of language and emotion communicated to the user.

Penny will have the following attributes:

- Empathetic: people know they won’t get an ear bashing when things go wrong

- Positive: a can-do attitude, focused on solutions

- Realistic: doesn’t get the customer’s hopes up

- Friendly: even when delivering bad news

- Fun: especially when reporting on the day-to-day

Penny will adopt different tone’s of voice depending on where the customer is in the collections process.

Example:

- If the customer hasn’t missed a payment yet, the tone can be more light-hearted.

- If the customer has missed any payments and is in real financial difficulty we will remain empathetic but direct while highlighting any consequences if needed.

What are the benefits?

For the user

- Doesn’t need to log into online banking

- Face-less; no human judgement

- No lengthy income and expenditure forms

- Fairer

- Avoid bank charges for accidents

For the lender

- Cost-efficient; less time and money spent chasing the customer

- Corporate Social Responsibility – refer people to organisations that can help

- Fewer people enter the collections process

- Minimise bad debt

Scenario

Given our time was finite, we choose to focus only on the one persona – Forgetful Fran.

In Fran’s case, she doesn’t have any financial difficulties but is just forgetful when it comes to her finances and payments.

She needs:

- An easy way to remember what money is going out when

- To know before it happens when she is going to miss a payment

- Reminders so she can keep on track

In this scenario, we broke down the sequence of events as followed:

- Fran’s bank balance is low and won’t cover her next outgoing direct debit payment

- Penny alerts Fran of this and offers options, Transfer Money from another account, pay with credit/debit card or remind me later

- Fran asks Penny to remind her later

- On schedule, Penny reminds Fran again of the low balance and upcoming direct debit

- Fran decides to easily transfer money from another account, using open banking which will cover her next outgoing payment

- Penny transfers funds and confirms direct debit payment was successful, avoiding paying any bank fees.

Prototype

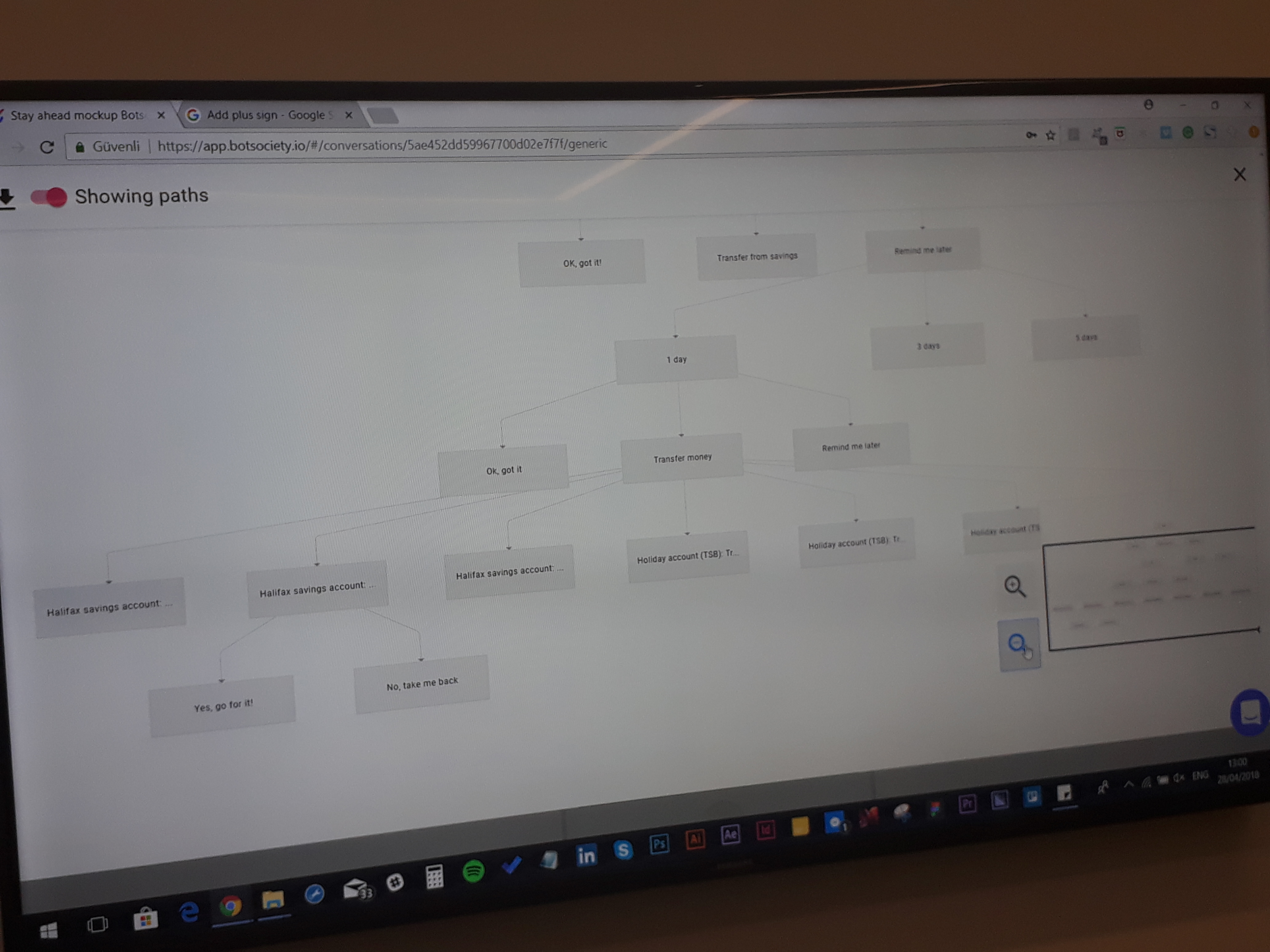

Now that we have finalised the scenario for Fran, we started drafting the script for the prototype.

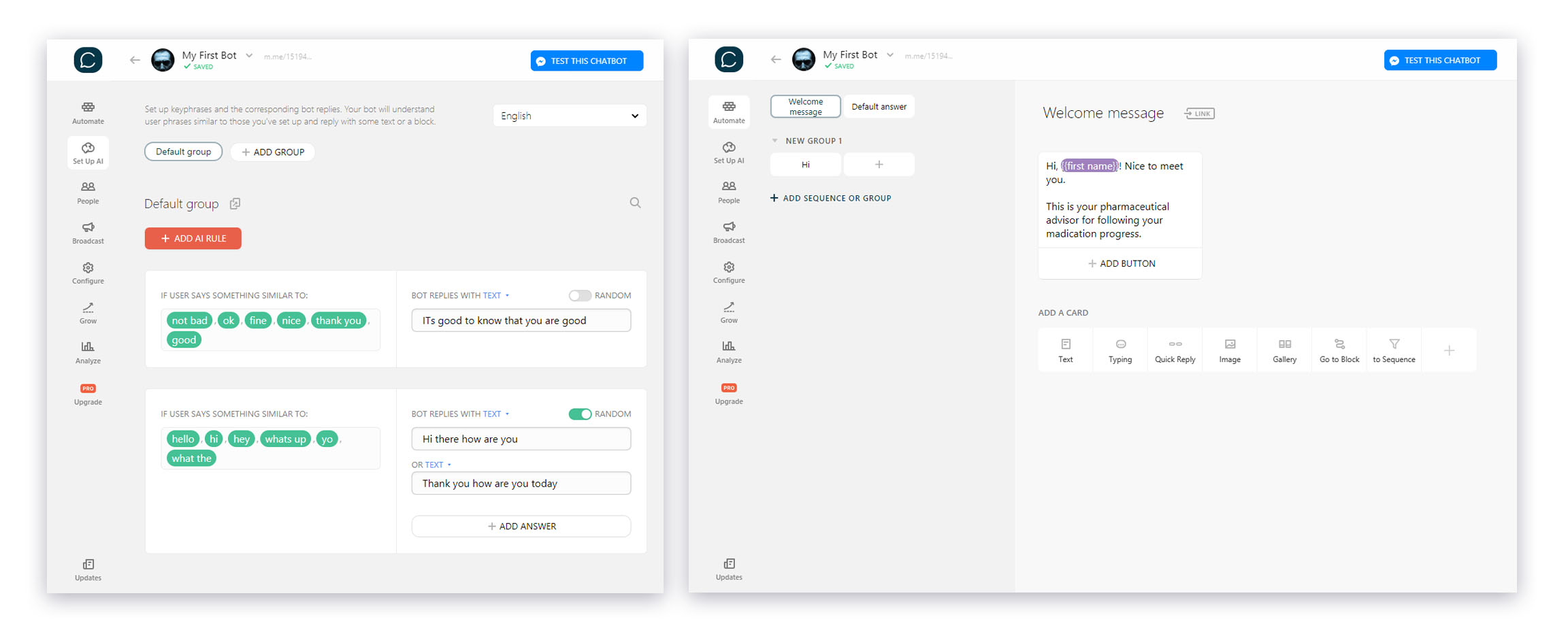

The team used a free prototyping tool for building chatbots called Botsociety.

Our first draft, we added all the conversation scripts discussed however after internal review— we agreed the conversation needed sprucing up…

From there, we added emojis, gifs and changed the conversation colour scheme (where appropriate).

Here is our final prototype for a conversation with Fran and Penny, enjoy!

Presenting Project

Projects were judged on:

- Originality

- Presentation

- Innovativeness

- Design

- Team collaboration

- Prototype

Our team was the last (but not least) to present out of 7 others.

After the presentation, we had to answer a number of questions about our chatbot to the panel including our vision for the future of this product and how users would discover Penny.

Outcome

Yes.!!!

We have been awarded as a winner of this great Hackathon.

Moving forward

For the future, I started to develop a Next-Generation Financial Assistant Chatbot that having features like;

- Intent Detection

Matching user inputs to AI responses with a seamless precision, utilising proprietary machine learning and Natural Language Processing abilities. - Rich Messages

Variety of different responses enables interactive, colourful and striking dialogues with buttons, galleries, images and videos. - Background Analytics

For a better understanding of customers insights, improve intelligence and total experience - Training Features

By creating an additional channel, users will have a chance to reach training materials in the conversational training environment